Nearly 20% of all US Dollars that EXIST right now were printed in 2020

Let that sink in…

The amount of money being pumped into the system has reached unprecedented levels as JPOW (FED Chair) has let the money printer go literal BRRR for the past 1 year since the March Crash in 2020.

This has had and WILL HAVE effects we have never seen before. Never before in the history of the world has monetary policy so generously padded the pockets of Americans, stimulus checks after stimulus checks and an unprecedented low interest rate to add to the loop.

Fiscal spending is also starting to pile up as Biden’s new infrastructure package is set to spend trillions of dollars in the coming few months.

When you have BOTH expansionary fiscal and monetary policy happening at the same time, AKA “Easy Money,” the devil is sure to arrive, and that is our best friend inflation.

This is what Warren Buffett said during Berkshire Hathaway’s recent AGM:

“We are seeing substantial inflation and are raising prices.”

I don’t think I need to talk about the implications of inflation in Venezuela. If you are curious to know more, you can read more here.

So how does this affect your portfolio? What does this all mean for the future? Today, I will cover the basics of inflation and how you can hedge against it.

Inflation 101: What the heck is inflation even?

While I am no Professor or economist, here are ideas which I understand so if I am wrong with certain things, feel free to leave constructive feedbacks behind!

Inflation in simple terms, is the decline in purchasing power of a given currency over time.

Simply put, one dollar buys less of a certain good in the future.

Put another way – it is a rise in the general price level of goods and services.

If you just look at this miserable graph of a declining, dying dollar, you will easily see how inflation manifested throughout history. $1 in 1913 is only worth $0.03 today.. meaning if you had $1 million in 1913, that would be $30,000 today.

Your wealth is literally being eaten away slowly but surely while the currency devalues 97% over the same time period.

Why has this happened?

An increase in overall price levels generally occurs when there is a lot of money in the financial system.

For example, if Joe Biden and Donald Trump send everyone $1,400 cheques at the same time that new iPhones come out during a pandemic – the prices of Apple iPhones on the Carousell resale market go up (because they’re all sold out).

There are 3 types of inflation: Demand-pull, Cost-push, or Built-in.

Essentially, inflation all comes down to WHAT forces are tugging at demand and supply. And there are MANY components but let’s keep this blog post as layman as possible. I don’t want to turn this into an economics lecture.

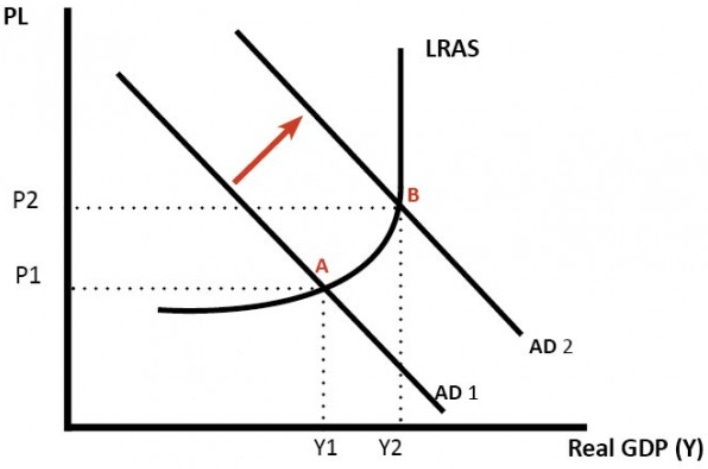

- Demand-pull inflation occurs when an increase in the supply of money drives demand for goods and services up. Increase in demand is faster than the increase in production (supply), driving prices up (shift from P1 to P2 as shown below).

In our iPhone example, more people are sitting at home with free time due to lockdowns right when a new iPhone comes out. At the same time the stimulus check hits, creating more buyers than sellers, pushing the demand curve out, and the price go upwards.

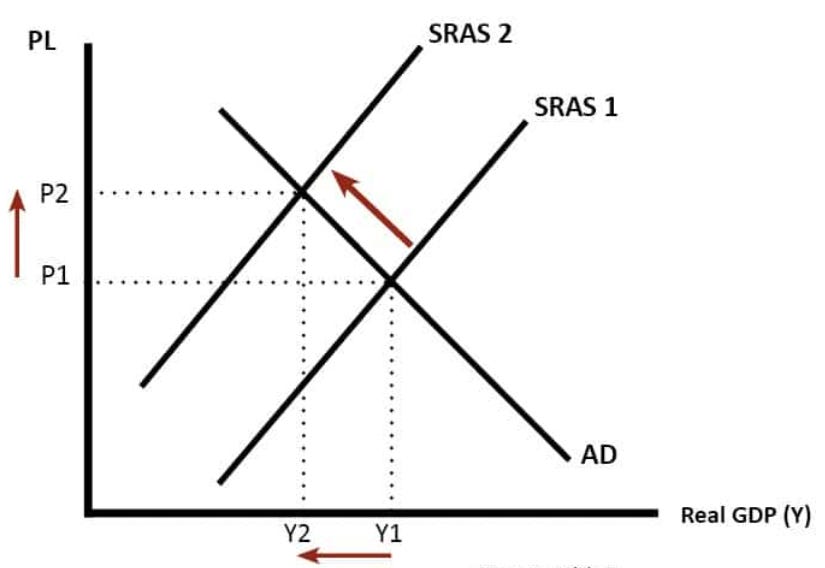

2. Cost-push inflation is a result of the increase in prices that work through the entire supply chain system. Following our iPhone example, if the current shortage in semiconductors persists (lower supply), the big semiconductor companies can charge more per Apple Bionic Chip.

In turn, Tim Cook and company want to keep their profit margin the same so they pass this cost onto Xiao Ming who is just trying out iPhone for the first time. The end result is a higher retail price at Singtel/Starhub/M1 for Xiao Ming to buy that iPhone.

3. Built-in inflation is basically an expectation on future inflation which are gauged by economists/economic participants.

The idea here is that people expect current inflation rates will continue in the future, so as the price of goods and services rises, workers come to expect that these prices will continue to rise at the same rate, therefore they demand higher wages. (Wage inflation)

Higher wages for workers allow them to maintain their standard of living, and not let their purchasing powers erode.

But if wages increase more than the price levels increase, workers will have more money to buy more things which then further pushes the price of goods up. (and yup that’s when inflation goes up)

The current situation

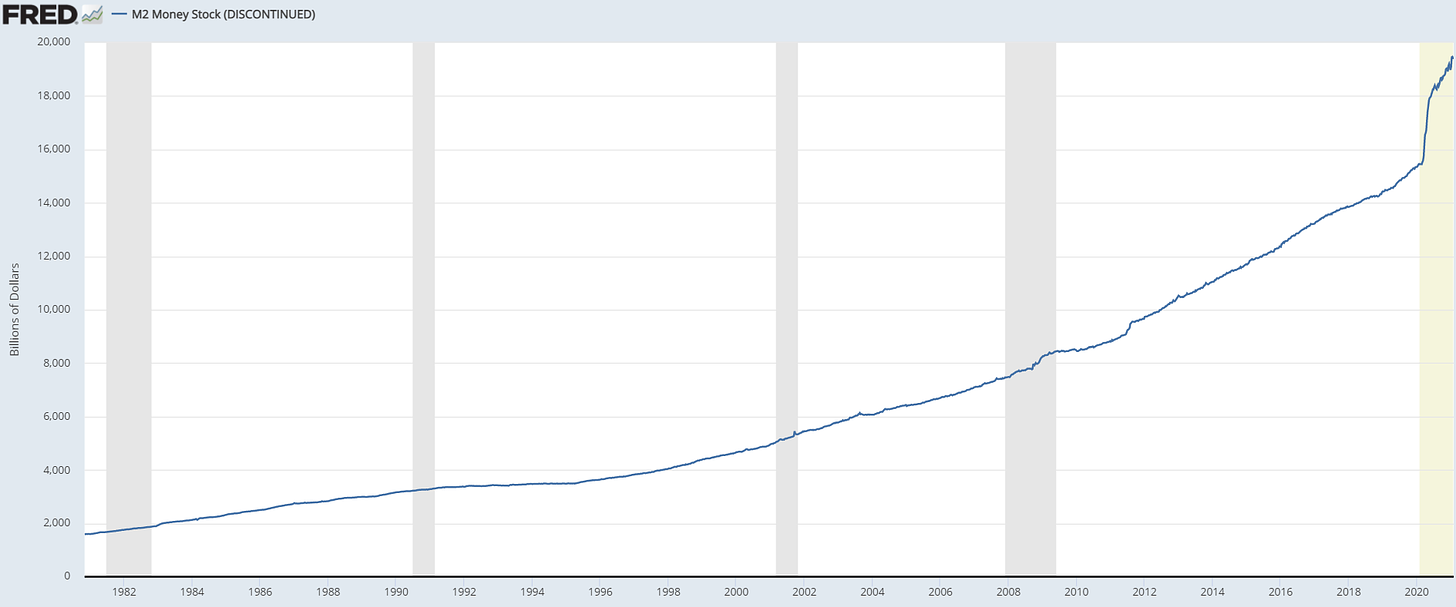

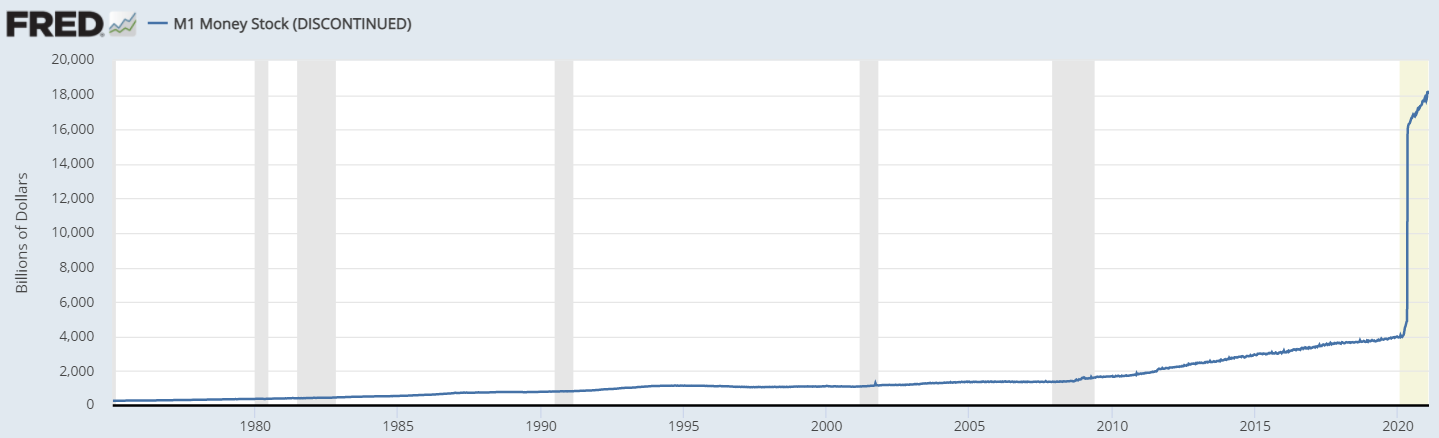

The most prominent charts are of the historic amount of money into the system versus now:

I would be scared if I were holding majority of my portfolio in cash right now.

Monetary policy = Controls Money Supply

Fiscal Policy = Controls Government Spending/Taxation

Right now, you will see the term “transitory” (temporary) dominate headlines in terms of why prices are higher today but may not be in the future.

Aside from consumer price inflation, we are also seeing asset inflation across many different commodities/assets such as:

- Copper

- Semiconductors

- Wheat

- Corn

- Gasoline

- Real Estate

- Car Prices

- Lumber (Wood)

- Equities

- Crypto

With interest rates at historic lows, financing these purchases become very cheap, coupled with tight supply and demand rocking and rolling, prices are going parabolic across all commodities and assets.

Implications to investment decisions

I would separate it out into 2 different scenarios: The Bull Case and The Bear Case

The Bear Case

On one hand, we have bears arguing that we are heading straight for hyperinflation just like the ones we saw in Venezuela or Weimar Republic, where the unlimited money printing is utilised by central banks to inflate their way out of debt.

If the money printing were to lead to 8%-20% inflation over the long run, we will see a central bank-induced recession as they print more money and everyone’s wealth gets destroyed.

The Bull Case

Rate hikes go up slowly over time, but the economy goes back to full production mode and grows alongside inflation. Increased capital investment deals with bottlenecks so you have a little rather than a lot of inflation.

For example, millions of automobiles can’t be built right now because of the semiconductor chip shortage. If this gets solved, pricing comes back down to earth.

If COVID-19 gets dealt with, the economy will be able to continue its upward trajectory and GDP continues to gap up.

In this scenario, we get mild inflation running above CPI but nothing worth concerning.

Still, I am a prudent investor and I can tell you one thing I won’t be doing, and that is letting my money gather dust in a savings account!

Because with inflation SAVERS are punished and INVESTORS are rewarded.

Investing Beanstock’s Gameplan

I am more of an optimist than a pessimist, therefore, I lean more towards the Bull Case. In this case, since I am expecting gradual rate hikes over time as the economy recovers, I am positioning my portfolio towards holding high quality equities and crypto to hedge this inflation hiking over the long run.

One thing we need to understand is the dynamics within the market. For example, the pandemic altered where people work and what they consume. So position your equities towards this trend as the world moves forward and not backward.

My equities portfolio consist of many “App Economy-centric” stocks which are easy on capex but have strong margins and revenue growth that can sustain over the long run.

While we are experiencing yet another round of “sector rotation” from Growth towards Value, remember the trend we are heading towards: Are you going to forgo Fintech for traditional banks with sh***y prospects or opting for legacy companies like IBM or Exxon Mobil instead of growing giants like Alibaba or Shopify?

Remember: Quality companies > Mediocre companies.

If the recent growth stocks plunge left you confused, overwhelmed and disappointed, ask yourself again: “In 10 years time, which company will be around and which won’t? Will the current correction affect the business in anyway?”

If the answer is no, you should hold on to the stocks and even opt to buy more if your warchest allows you to.

However, if your answer is “I don’t even know why I bought it in the first place or it just keeps going up but now its going down“, then please please think twice before buying a stock as it is of utmost importance to know what you own.

With bond yields at historic lows, another area that is getting a lot of focus is alternative investments such as Bitcoin. The 60/40 portfolio of equities/bonds simply doesn’t work anymore, what works is probably more of a 60/20/20 allocation with the introduction of alternative assets.

Gresham’s Law: Bad money drives out good money (from circulation)

The above law simply states that bad money (fiat, paper money) will essentially drive out good money (Bitcoin/crypto/more superior form of money) out of circulation, because people will simply spend cash (the bad money) but will hoard and store more valuable forms of money which will drive valuable money out of its circulation. (Lesser supply of good money = Higher price of good money).

This is literally the phenomenon we are seeing right now with the surge of Bitcoin, Ethereum and other crypto assets in the wake of the monstrous money printing by the central banks.

I personally don’t own bonds because I am not a boomer, but I understand some can’t live without them due to the perception of bonds as “safe.” (Well not exactly because bonds have their own inherent risk as well)

The wealthy are also diversifying into alternative assets like high end art, (NFTs) wine, and sneaker collectibles etc.

Essentially, Bitcoin and crypto is another form of inflation-protected assets which allows you to diversify away from the stock market but still providing your portfolio with store of value and the ability to hedge against inflation over the long run. (Especially so with the money printing going on)

For my full asset allocation, you can check out my portfolio here.

And that’s it! Here’s how I personally see the future of inflation ahead and just a brief overview into understanding inflation and how you hedge against it. My personal take is that higher inflation is inevitable and to be prepared for it rather than sitting duck for the news to announce it.

Quick Thoughts on Crypto Market

My personal view on crypto though, is that the bull market is only in the early innings based on on-chain metrics and there are further upsides left to the bull run before the cycle ends.

Crypto is a whole new different animal so its really futile to compare it to the stock market, which I find many no-coiners using mean reversion theory as a thesis for bearish arguement.

Always remember to have a proper entry and exit strategy in place.

If you have any questions, feedbacks or thoughts, feel free to leave a comment below. Happy investing!

Join My Tele Channel Here For Blog Updates And More!

I use StocksCafe to keep track of all my investments (include Robo) + research on stocks. You can also view my portfolio as well as many others so you can compare your own performance with other investors. If you are interested in signing up, you can use my referral link to sign up and access premium features for 1 extra month for new users. (3 months)

The Power of Low Fees

One huge advantage I have as an investor is paying very minute fees which can really eat into returns in the long run because I am using Firstrade to buy US Stocks which has absolutely $0 fees and extremely fast wire transfers for deposits and lightning fast trade executions.

Ever since I switch to Firstrade last year as my main investment vehicle, I saved up on a ton of fees and hence able to achieve way better returns than before. I saved up more than 5 times the fee paid in 2018, 2019 and 2020 this year due to the switch and I am really happy thus far.

Of my entire investments in 2020, fees only take up 0.1% of my entire portfolio! (2018+2019+2020 combined across all brokers and Robo)

Alright that’s it! For now, think long term, tune out the noise and avoid the temptation of gambling meme stocks, think of the companies that will do well in the long run simply find bargains/dollar cost into your positions. If you need some inspiration for companies to research, you can check out my post on 5 stocks to buy if the market crashes here.

For those who are already into Crypto

Want to learn how you can earn high yielding interest rates on your idle crypto assets in a secure, safe and easy manner? You can read up more on my post here or do your due diligence on Bitcoin here and also my crypto exchange of choice Gemini here if you are looking to buy your first crypto!

Referral Links (Click and Sign Up)

Gemini Exchange: Deposits and buy US$100 or more crypto on Gemini and you will earn US$10 in BTC.

Coinhako Exchange: You can create an account by clicking the link and then enter promo code: COINGECKO when doing a buy/sell and enjoy 20% trading fees discount!

Binance Exchange: Create a Binance.com account here and trade the widest range of crypto pairings!

Celsius Network: Earn US$40 in BTC for free with your first transfer of US$400 or more in any crypto asset and wait for 1 month!

Nexo: No referral events at the moment 😦 Just sign up and enjoy this great product!

TL;DR Syfe Promo Code

For people who are interested to invest into Syfe and wants to open an account, you can use the promo code below as a bonus 🙂

Promo Code: SRPTH8LK3

6 Months management fee waiver for the first deposit of $1000 (or more)!

“Always remember to have a proper entry and exit strategy in place.”

Now I believe you still have a risk management in mind lol

LikeLike